How Much Is Health Insurance a Month Blue Cross for 25yr Old

- Cheapest health insurance rates

- Cheapest plans by county

- Health insurance rate changes in Florida

- Short-term health insurance in Florida

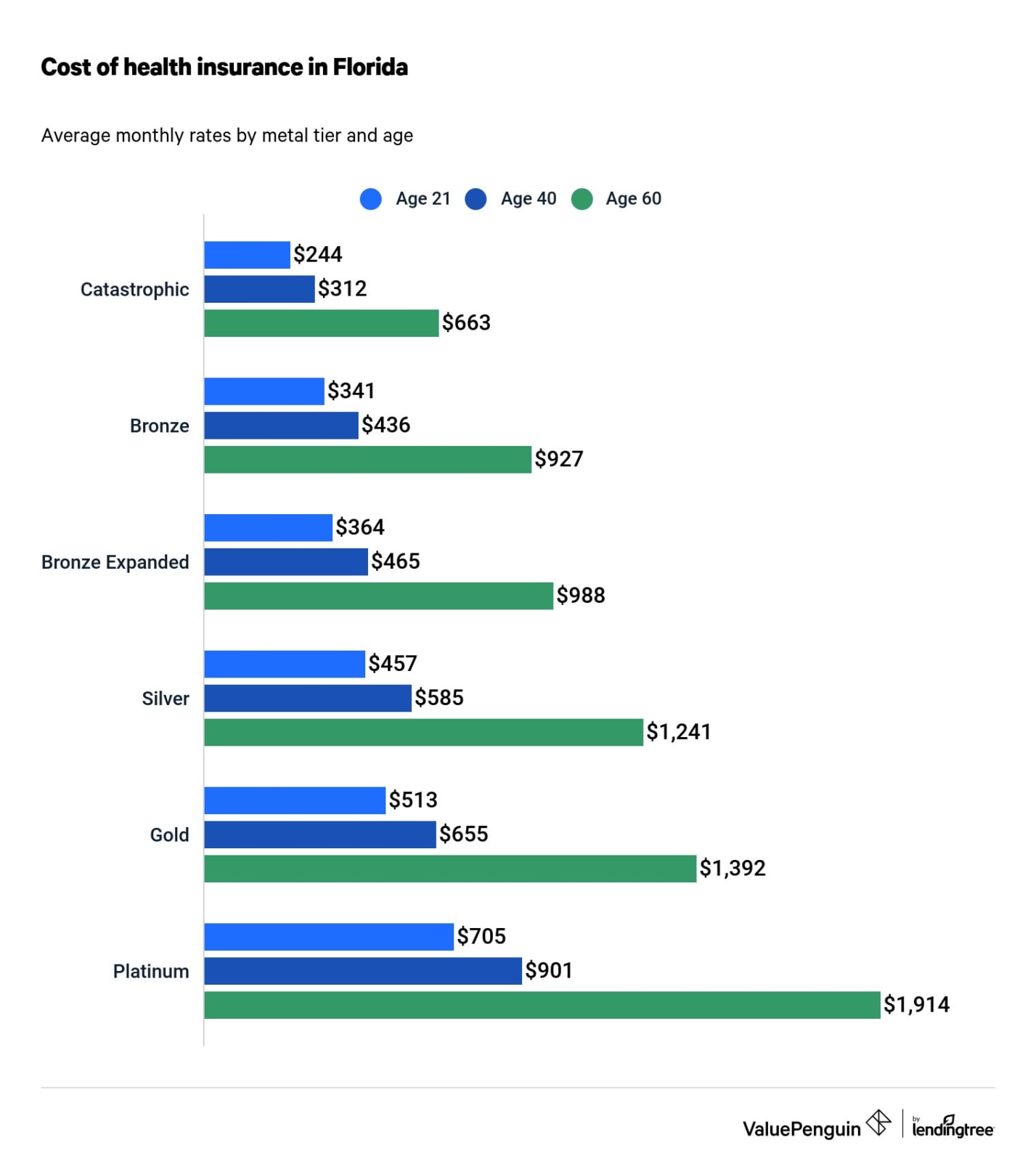

The average cost of health insurance is $559 per month for a 40-year-old in Florida.

We compared the health insurance plans available on the Florida marketplace and identified the cheapest policy in each metal tier to help you find the best option for your chosen level of coverage. Aside from the level of coverage, one of the most significant factors in determining health insurance rates is the age of each person insured.

Find Cheap Health Insurance Quotes in Florida

A 21-year-old will receive 28% cheaper prices for health insurance in Florida than a 40-year-old. A 60-year-old would pay 112% higher monthly premiums.

The best health insurance plans you can choose from will vary by the county you live in, and not all of those listed below are available in every county. We recommend using these as a starting point when assessing the benefits and out-of-pocket costs you can expect from a health plan, as compared to monthly premiums.

| Metal tier | Cheapest plan | Monthly cost | Deductible | Maximum out-of-pocket |

|---|---|---|---|---|

| Catastrophic | Health First GYM ACCESS Catastrophic HMO 1746 | $195 | $8,700 | $8,700 |

| Bronze | Molina Core Care Bronze 1 | $338 | $6,100 | $8,550 |

| Bronze Expanded | Health First Bronze VALUE 60 1814 | $325 | $8,300 | $8,700 |

| Silver | Health First Silver VALUE 80 1815 | $430 | $6,500 | $8,700 |

| Gold | Health First Gold VALUE 80 1819 | $460 | $2,900 | $8,700 |

| Platinum | BlueSelect Platinum 1451 ($0 Virtual Visits / Rewards $$$) | $657 | $1,250 | $4,250 |

How to find your best health insurance plans in Florida

Premiums are not the only cost component when it comes to your health care. Out-of-pocket costs in the form of deductibles, copays and coinsurance are just as important to compare when you shop because these amounts will determine how much you spend on medical care.

The best cheap health insurance plan for you and your family will depend on your income level and expected health care needs.

Households with higher expected medical costs should opt for plans with higher cost-sharing benefits. In contrast, those who expect to be relatively healthy or need little to no routine care should look for cheaper plans.

Start by browsing Silver plans

Unless you're extremely healthy or know you'll have significant medical expenses, we advise beginning your shopping process by looking at the Silver metal tier health insurance plans. These plans occupy a middle ground between monthly premiums and the cost-sharing responsibilities that you will pay with any medical expenses.

The Silver plans are also the only plans on the Florida exchange that make you eligible for cost-sharing reductions that further reduce your copays, coinsurance and deductibles if you have a household income under 250% of the federal poverty level.

In this case, these plans can actually offer more benefits than higher-priced Gold and Platinum plans but at a much lower premium.

Younger and healthier people can save with Bronze and Catastrophic plans

Bronze and Catastrophic plans will have the lowest premiums available, but the downside is they have high deductibles. Many plans in these metal tiers will have their cost sharing near the maximum limits, meaning that you will first need to spend thousands of dollars before many of the plan's benefits kick in.

These types of health insurance policies only make sense if you want coverage for costly emergencies and have little to no need for routine care. Catastrophic plans are available to those under age 30, and for those over 30, you'll need a hardship exemption to be eligible. Keep in mind that all metal tiers except Catastrophic are eligible for premium tax credits.

Health insurance rate changes in Florida

Health insurance rates, deductibles and out-of-pocket maximums are set yearly by health insurance companies. The plans are then sent to the federal exchange to be approved for the following plan year.

In Florida, the cost of health insurance plans increased an average of 6% from 2021 to 2022. That's about $31 more per month.

The largest price increase was for Platinum plans, which cost 9% more in 2022. Gold, Bronze and Expanded Bronze plans increased between 5% to 7%. Silver and Catastrophic plans had the smallest change, increasing 2% to 3% between 2021 and 2022.

| Metal tier | 2020 | 2021 | 2022 | Change (2022 vs. 2021) |

|---|---|---|---|---|

| Catastrophic | $269 | $303 | $312 | 3% |

| Bronze | $401 | $414 | $436 | 5% |

| Bronze Expanded | $434 | $433 | $465 | 7% |

| Silver | $584 | $571 | $585 | 2% |

| Gold | $624 | $618 | $655 | 6% |

| Platinum | $825 | $827 | $901 | 9% |

Monthly premiums are for a 40-year-old adult.

Short-term health insurance in Florida

Florida follows the regulations set by federal guidelines for short-term health insurance. This allows for the plans to provide coverage for up to 12 months and be renewable for up to 36 months. Furthermore, short-term plans do not need to cover the essential benefits that all Affordable Care Act (ACA) marketplace plans must cover.

This includes services like maternity, hospitalization, mental health and prescription drugs.

You may want to consider purchasing short-term health insurance if you lose employer-sponsored coverage or miss open enrollment for an ACA marketplace policy. However, it is important to note that short-term plans require medical underwriting and typically do not provide coverage for preexisting conditions.

Find Cheap Health Insurance Quotes in Florida

Best cheap health insurance companies in Florida

Ten health insurance providers currently offer plans on the Florida marketplace.

Florida health insurance companies

- AvMed, Inc.

- Blue Cross and Blue Shield of Florida

- Bright Health Insurance Company of Florida

- Celtic Insurance Company

- Cigna Health and Life Insurance Company

- Florida Health Care Plan, Inc.

- Health First Commercial Plans, Inc.

- Health Options, Inc.

- Molina Healthcare of Florida, Inc.

- Oscar Insurance Company of Florida

In 2022, HealthFirst offers the cheapest health insurance for Gold, Silver, Expanded Bronze and Catastrophic plans. BlueSelect has the most affordable rates for Platinum, and Molina has the best rates for Bronze plans.

Cheapest health insurance plan by county

As mentioned above, we advise shoppers to begin their insurance buying process by looking at Silver plans. To help you, we've listed the cheapest Silver health plan for each Florida county, as well as sample prices for families of different sizes.

These premium estimates are unsubsidized. Depending on your income, you will likely see even lower prices once you account for the tax credits.

| County name | Cheapest plan | Age 40 | Couple, age 40 | Couple, age 40 & child |

|---|---|---|---|---|

| Alachua | Ambetter Balanced Care 30 | $503 | $1,006 | $1,307 |

| Baker | BlueSelect Silver 1443 ($0 Labs / $0 Virtual Visits / Rewards $$$) | $486 | $972 | $1,263 |

| Bay | BlueSelect Silver 1443 ($0 Labs / $0 Virtual Visits / Rewards $$$) | $486 | $972 | $1,263 |

| Bradford | Ambetter Balanced Care 30 | $503 | $1,006 | $1,307 |

| Brevard | Health First Silver VALUE 80 1815 | $430 | $859 | $1,116 |

| Broward | Constant Care Silver 4 | $442 | $883 | $1,148 |

| Calhoun | Ambetter Balanced Care 30 | $503 | $1,006 | $1,307 |

| Charlotte | BlueSelect Silver 1443 ($0 Labs / $0 Virtual Visits / Rewards $$$) | $486 | $972 | $1,263 |

| Citrus | BlueSelect Silver 1443 ($0 Labs / $0 Virtual Visits / Rewards $$$) | $486 | $972 | $1,263 |

| Clay | Constant Care Silver 4 | $442 | $883 | $1,148 |

| Collier | myBlue Silver 2010 ($0 Labs / $0 Virtual Visits / Rewards $$$) | $478 | $955 | $1,241 |

| Columbia | Ambetter Balanced Care 30 | $503 | $1,006 | $1,307 |

Show All Rows

Recap of the best cheap health insurance in Florida

- Catastrophic: Health First GYM ACCESS Catastrophic HMO 1746

- Bronze: Molina Core Care Bronze 1

- Expanded Bronze: Health First Bronze VALUE 60 1814

- Silver: Health First Silver VALUE 80 1815

- Gold: Health First Gold VALUE 80 1819

- Platinum: BlueSelect Platinum 1451 ($0 Virtual Visits / Rewards)

Frequently asked questions

What is the average cost of health insurance in Florida?

The average cost of health insurance in Florida for 2022 is $559 for a 40-year-old. However, this average cost will change greatly depending on the metal tier of coverage you select and age. For example, a 21-year-old has health insurance prices that are 28% cheaper than a 40-year-old.

Which company has the most affordable health insurance in Florida?

In Florida, the cheapest insurer in most counties is Ambetter, which has significantly cheaper policies compared to other major health insurance providers in the state. In 2022, the Ambetter Balanced Care 30 plan costs $503 per month.

How do I get cheap health insurance in Florida?

The best way to find a cheap health insurance policy is to compare policies from a variety of insurers. By getting quotes from many companies, you'll be able to understand why some companies have more expensive plans compared to others. Then, using your own criteria for what you want in a health insurance policy, you can choose the best one for your situation.

Methodology

Health insurance premiums, deductibles and out-of-pocket maximums for Florida were compiled through the Centers for Medicare & Medicaid Services (CMS) government website. ValuePenguin used the Public Use Files (PUF) to calculate average premiums by metal tier, county and family size. Plans and providers for which county-level data was included in the CMS' Crosswalk file were used in our analysis; those excluded from this dataset may not appear.

Source: https://www.valuepenguin.com/best-cheap-health-insurance-florida

0 Response to "How Much Is Health Insurance a Month Blue Cross for 25yr Old"

Post a Comment